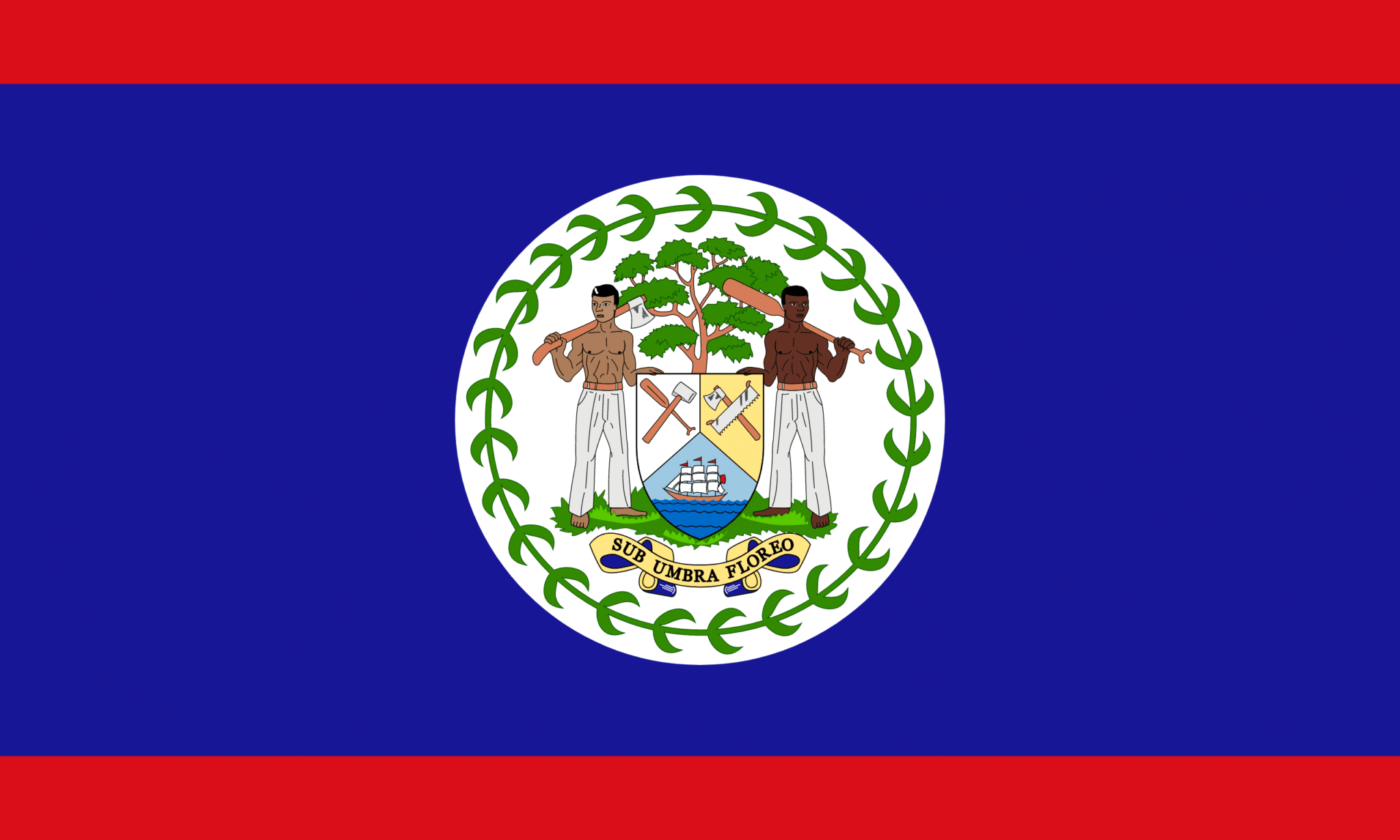

Belize

Table of Contents

Belize PEO & Employer of Record

WeHG provides an International PEO and global Employer of Record service in Belize to companies willing to enter the Belizean market or hire local/expat employees in this country.

The worldwide approach requires establishing a subsidiary in Belize. Still and all our company allows you to start the operations in Belize within days hence save time and money. WeHG would hire candidates on your behalf while you keep total operational control of their work. So legally they would be our employees, on our local payroll, 100% compliant but will work on your behalf.

Belize fast facts

Population, million: 397

Land area: 22,966 km²

Capital: Belize city

Local currency: Belize dollar (BZD)

GDP per capita:$ 9,576

GDP in currency:$ 3.484 billion

Belize, country located on the northeast coast of Central America. Belize, which was known as British Honduras until 1973, was the last British colony on the American mainland. Its prolonged path to independence was marked by a unique international campaign (even while it was still a British colony) against the irredentist claims of its neighbour Guatemala. Belize achieved independence on September 21, 1981, but it has retained its historical link with the United Kingdom through membership in the Commonwealth.

Hiring, Negotiating and Doing Business in Belize

Necessity of written employment contract

All contracts of service, other than contracts which are required by the Labor Code or any other law to be made in writing, may be made orally.

Different forms of engagement: employment, contracting, work with private entrepreneur

In Belize, there are two types of work permit. One work permit is for a local company who wants to hire a foreign person (you) while the other work permit is for temporary self-employment.

You can fill out a work permit application even before you’re hired, but it is best if the potential employer assists you. In order to qualify for a work permit, you must be a legal resident of the country and have spent at least six months in Belize.

If the work permit is granted for a local business to hire a foreign person, the company, not the applicant, will be the entity that receives the work permit. This means that if you decide to change employers later, you’ll need to file for a new work permit.

Belize Employment Contract

Types of employment agreements

- Re-engagement contracts.

The maximum period of service that may be stipulated in any re-engagement contract made on the expiry of a contract shall be twelve months, but in a re-engagement contract with a worker who is accompanied by his wife and children the said maximum period shall be two years. - Extra-territorial contracts.

When a contract made within Belize relates to employment in another

territory (in this section referred to as the territory of employment). - Contracts by children and young persons.

A child shall not be capable of entering into a contract. A young person shall not be capable of entering into a contract except for employment in an occupation approved by a labour officer as not being injurious to the moral or physical development of non-adults.

Belize working hours

The standard work week in Belize is 45 hours or six days a week, with paid overtime. All workers are entitled to a yearly paid vacation of two weeks. An employee who has worked for 60 days in a period of 12 months is entitled to sick leave of 16 days. Meanwhile, pregnant employees are given 30 days’ worth of sick leave for illnesses that are related to pregnancy.

Overtime

Employees are required to be paid at a rate of not less than one and one-half times the ordinary rate of pay for hours worked in excess of 9 hours in any day or 45 hours in any week.

If any worker works for and at the request of his employer on a

public holiday or a Sunday or other agreed rest day or for more than nine hours in any day or forty-five hours in any week, he shall be paid wages for such extra work at the following rates:

- on Christmas Day, Good Friday, and Easter Monday – at a rate of not less than double his ordinary rate of pay;

- on public holidays, hereof – at a rate of not less than one and one-half times his ordinary rate of pay;

- on Sundays or other agreed rest days – at a rate of not less than one and one-half times his ordinary rate of pay; and

- for hours worked in excess of nine hours in any day or fortyfive hours in any week – at a rate of not less than one and onehalf times his ordinary rate of pay.

Vacation leave in Belize

Every employee at the end of each year is entitled to an annual leave of at least 2 working weeks.

The annual leave shall be given and taken in one period, or if the employer and employee so agree, in two separate periods and not otherwise. If the employer and employee so agree, the annual leave or either of such separate periods may be taken wholly or partly in advance before the employee has become entitled to such a holiday.

The annual leave shall be given by the employer and shall be taken by the employee before the expiration of six months after the date upon which the right to such leave accrued, provided that the giving and taking of the whole or any separate period of such leave may, with the consent in writing of the Commissioner, be further postponed for a period to be specified by the Commissioner.

Belize Maternity Leave

A female employee is entitled to 14 weeks of maternity leave on full pay. Maternity leave shall be taken as follows:

Up to a maximum of 7 weeks before the expected date of confinement;

The balance after the expected date of confinement;

2 weeks before and 7 weeks after the expected date of confinement is mandatory.

Provided that during the twelve months preceding her confinement she was employed by the same employer for a period of not less than 150 days to qualify for full payment from the employer.

Belize Severance Laws

The Labour Law provides for both severance pay and redundancy pay. Payments at the the end of contract include payment of last month’s wage, payment for unused leave and severance pay as applicable.

On the expiry or termination of a fixed term contract, the employee has the right to receive severance pay. Severance pay must be at least 5% of the total wages paid to the worker during the length of a fixed term contract.

On termination of the employment, severance pay is payable to retrenched workers (terminated for economic reasons and other reasons except for serious misconduct), depending upon the length of service, at the following rates:

– 7 days wages for employment from 06 months to 12 months; and

– 15 days wages for every year of employment (up to a maximum of 6 months wages)

Workers are also entitled to severance pay on contract termination due to health reasons. No severance payment is granted if a worker’s employment contract is terminated due to serious misconduct. The limit on severance pay to the maximum of 6 months’ wages has been removed in 2018 amendment.

Unless an employer can provide sufficient cause for dismissal without notice (due to misconduct, disobedience, lack of skill, neglect of duties, or absence without permission), written notice is required.

- 2 weeks – 6 months

3 days notice or payment in lieu

- 6 months – l year

l week notice or payment in lieu

- l year – 2 years

2 weeks notice or payment in lieu

Belize Tax

In general, Belizean workers who earn less than BZ$20,000 a year or approximately US$10,000 a year are not subject to pay income tax. Everyone else who earns more than the said rate will be taxed 25% on their salary. For those employed by a company, tax payments are done using the PAYE system.

Health Insurance Benefits in Belize

An employee has to be employed for at least 60 days to be entitled to sick leave with pay. Within any 12 months period, he is entitled to 16 working days of sick leave with full pay. An employee should produce a medical certificate to be entitled to sick leave with pay. An employer should give a worker in writing 48 hours to produce a medical certificate.

Payment for Sick Leave

The employer pays the difference between payments made by the Social Security Board (SSB) and the employee’s basic rate of pay for 16 working days. Payment after the 16 working days of illness will be paid by Social Security in accordance with the Social Security Act. Labour Act; Sec 131.

Additional Benefits in Belize

Setting up an offshore company does not mean you need to break a bank to do so. In Belize, reduced operating costs makes offshore company incorporation an affordable investment choice. Therefore, many people find that doing business in Belize is far more affordable than other countries.

The attractive tax regime is another plus point that makes Belize stands out as one of the favoured investment hotspots. Belize imposes zero capital gains tax on any income generated out of Belize or within Belize. Other than that, the residency program (or commonly known as QRP) enables eligible individuals (age 45 and above and their families) to stay in Belize without having to file their income tax returns or pay their customs duties on personal property (including vehicles). Furthermore, Belize does not levy on income generated (including pension payments) outside of Belize. For Belize’s residents, the first $14,500 of income earned within Belize is also tax-exempted. Though you are not a citizen of Belize, you have the equal rights to own, sell, and rent property in the country.

General market practice benefits/additional allowances

Certain Belize international business companies (IBCs) carrying on relevant activities or regulated under Belize IFSC Act shall be subject to the Economic Substance Act, 2019 in the Belize.

“Relevant activities” under the Belize ES regime include: Banking, Insurance, Fund management, Finance and leasing, Headquarters, Shipping, Holding company, and Distribution and service centers.

All in-scope IBCs under this regime must fulfill the compliance duties or economic substance test for each relevant activity they engage in.

Belize Holidays

There are 13 public and bank holidays in Belize.

- New Years Day

- Baron Bliss Day (9th March)

- Good Friday

- Holy Saturday

- Easter Monday

- Labour Day (1st May)

- Commonwealth Day (24th May)

- National Day (10th September)

- Independence Day (21st September)

- Pan -American Day (12th October)

- Garifuna Settlement Day (19th November)

- Christmas Day

- Boxing Day (26th December)

The days on which the holidays are commemorated are published each year in the Government Gazette.

Why Choose WeHireGlobally

WeHG takes care of all the onboarding hurdles, payroll, compensation and benefits, tax filing, and termination of employment. Our Employer of Record solution allows you to manage your overseas teams efficiently while minimizing cost and risk.

FAQ Belize

The standard work week in Belize is 45 hours or six days a week, with paid overtime. All workers are entitled to a yearly paid vacation of two weeks.

- New Years Day

- Baron Bliss Day (9th March)

- Good Friday

- Holy Saturday

- Easter Monday

- Labour Day (1st May)

- Commonwealth Day (24th May)

- National Day (10th September)

- Independence Day (21st September)

- Pan -American Day (12th October)

- Garifuna Settlement Day (19th November)

- Christmas Day

- Boxing Day (26th December)

In general, Belizean workers who earn less than BZ$20,000 a year or approximately US$10,000 a year are not subject to pay income tax. Everyone else who earns more than the said rate will be taxed 25% on their salary. For those employed by a company, tax payments are done using the PAYE system.