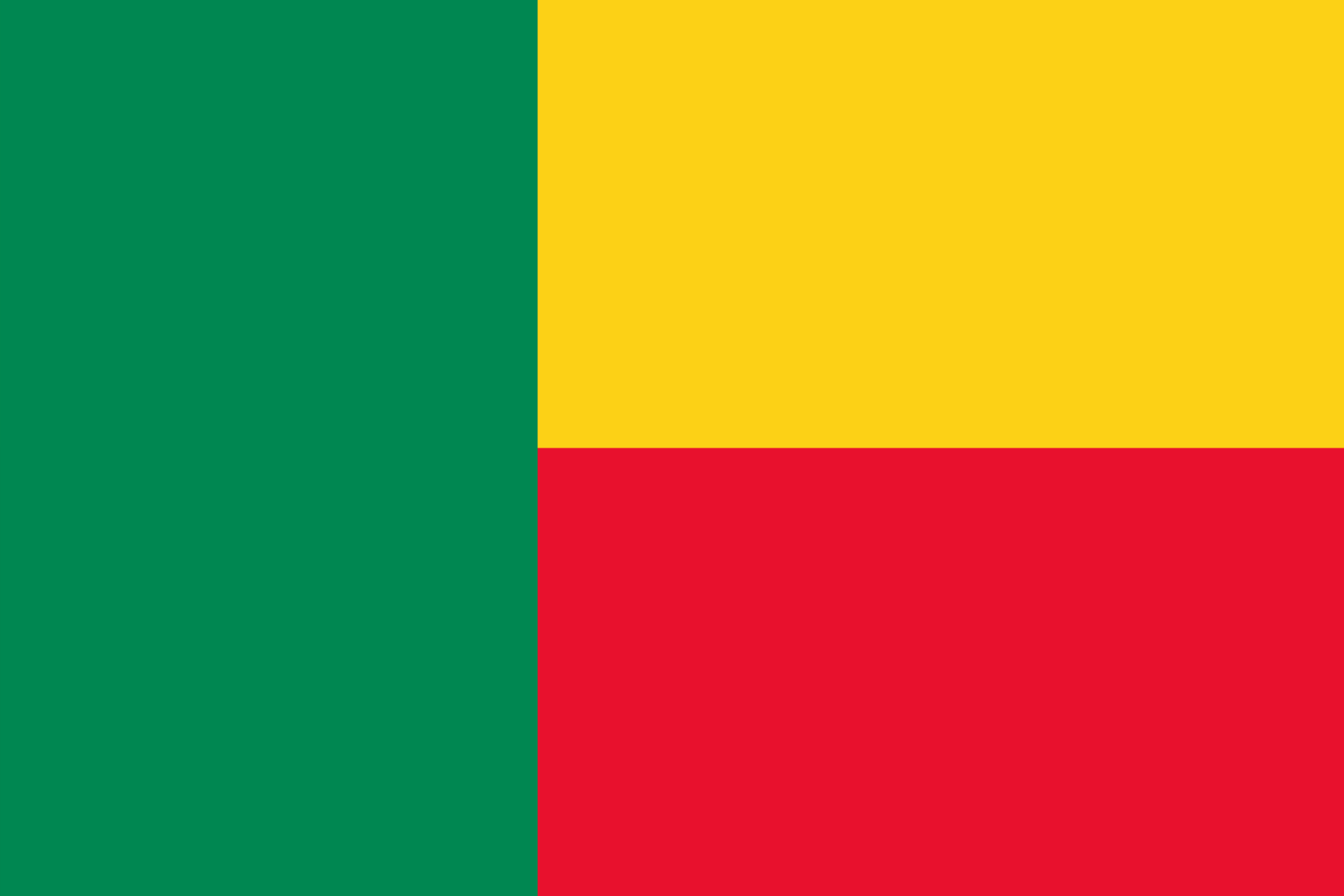

Benin

Benin PEO & Employer of Record

WeHG provides an International PEO and vglobal Employer of Record service in Benin to companies willing to enter the Benin market or hire local/expat employees in this country.

Traditional approach requires establishing a subsidiary in Benin. Meanwhile, our solution allows you to start the operations in Benin within days hence save time and money. WeHG would hire candidates on your behalf while you maintain full operational control of their work. So legally they would be our employees, on our local payroll, 100% compliant but will work on your behalf.

Benin fast facts

Population, million: 12,123,200

Land area, sq. km: 114,763 km²

Capital: Porto-Novo

Local currency: West African CFA franc (XOF)

GDP per capita:$ 1150.00

GDP in currency:$ 12 billion

Economic growth percentage: 6.7%

Inflation rate (consumer prices): 2.5%

Volume of export: $ 65.83 million

Import of goods and services: $49 million

Total population: 12,123,200

Population of working age (15-64): 59.87%

Benin, officially Republic of Benin, French République du Bénin, formerly (until 1975) Dahomey or (1975–90) People’s Republic of Benin, country of western Africa. It consists of a narrow wedge of territory extending northward for about 420 miles (675 kilometres) from the Gulf of Guinea in the Atlantic Ocean, on which it has a 75-mile seacoast, to the Niger River, which forms part of Benin’s northern border with Niger. Benin is bordered to the northwest by Burkina Faso, to the east by Nigeria, and to the west by Togo. The official capital is Porto-Novo, but Cotonou is Benin’s largest city, its chief port, and its de facto administrative capital. Benin was a French colony from the late 19th century until 1960.

Hiring, Negotiating and Doing Business in Benin

Necessity of written employment contract

It may be oral or in writing and may be concluded for a specific term or for an indefinite duration. However, when an employment contract is verbal, it is for indefinite duration.

The following contracts must be in writing: contract of apprenticeship; fixed term contract exceeding one month; employment contract where worker has to perform work outside the place of his usual residence; contract of migrant workers and the probationary/test term contract. A contract of employment may be concluded for a specific term, work or for an indefinite period.

Government has enacted a new law in August 2017 (Law No. 2017-05) which deals with employment contract and its termination, by either of the parties. In line with the 2017 law, the probation period and contract termination notice period must be specified in the employment contract.

Benin Employment Contract

Types of employment agreements

Fixed-term contract is a contract in which duration of the contract is indicated precisely and fixed in advance. The maximum duration of a single fixed term contract is two years however since it is renewable once, the total term of the fixed term contract is 48 months.

This contract is reviewed and registered by the Ministry of Labour. A fixed duration contract may have an unspecified end date if it is concluded for replacing a worker who is temporarily absent; for work carried out during a season; and occasional periods of extra work or non-customary activity of the enterprise. Such contract expires on the return of temporarily absent employee; end of the season; and end of the occasional periods of extra work or non-customary activity of the enterprise.

Seasonal, temporary or casual contract are of 6 month duration but they can be renewed as many times as possible until the objective condition (for signing them at the first place) remains. A contract that does not meet the requirements related to fixed term contract is considered to be a contract of indefinite duration. A fixed term contract is subject to certain future event whose date is not known or linked to specific task or work. Beninese labour Law allows hiring fixed term contract workers for tasks of permanent nature. A fixed-term contract can be reviewed indefinitely. However, from the fourth term of the fixed-term contract, any decision to non-renewal is preceded by a notice established under the conditions specified by the Labour Code.

A permanent employment contract is concluded for an indefinite period. The term can be part-time or full-time, which is not prior fixed and can be ended at any time. The part-time employment contract (open-ended contract) should be in writing which includes qualification of workers, elements of remuneration, weekly duration, distribution of working hours. A part-time contract can be concluded for a period which is at least 20% less than the full-time contract. Part-time workers enjoy all the rights that are entitled to full-time workers. The work contract can be modified within the reflection period of 8 days. If the suggested modification by either party is substantial and employee or employer refused to follow, the contract can be terminated.

Previously, employers were required to move employees onto permanent contracts (CDI) after a fixed term contract. This requirement is removed under the new law.

Benin working hours

40 hours per week for all other workers.

Overtime

Overtime work during day is compensated at following rates –

- 112% of normal hourly rate for 41st to the 48th hour;

- and – 135% of normal hourly rate beyond the 48th hour.

Vacation leave in Benin

The Labour Law provides for annual leave to all workers on completion of one year of service called reference period. A worker is entitled to 24 working days of paid annual leave (at the rate of two working days per month of employment) on completion of 12 months of continuous service. Annual leave increases with the length of service.

The annual leave increases by two working days after 20 years of continuous service, four working days after 25 years of service and six working days after 30 years of service in the same enterprise. The cumulative duration of leave may not exceed 30 working days for 12 months of work. The leave has to be taken in the following twelve months.

Sick leave

Both Labour Code and Collective Agreement provide for the paid sick leave. The duration of the period of sick leave depends on the length of service. It is: – 06 months for a period of service less than 24 months; – 12 months for a period of service equal to or greater than 24 months. As for the compensation for sick leave, it is: – equal to respective notice period for less than 12 months of consecutive service. – equal to full pay for 3 months and half pay for other 3 months for 1 to 5 years of service.

Benin Maternity Leave

Maternity leave

A later convention (No. 183 from year 2000) requires that maternity leave be at least 14 weeks of which a period of six weeks compulsory leave should be after childbirth.

Pregnant workers (insured or wife of the insured) receive free maternity related medical care including maternity and child health and welfare services. It is not expressly mentioned if medical care is provided after confinement.

Paternity Leave

Although paternity leave is not clearly provided under Labour Code, the Collective Labour Agreement provides for 3 days leave for birth at home which can be taken as paternity leave by fathers.

Benin Severance Laws

Termination Process

A fixed term contract terminates at the end of its term by written agreement of the parties; or by gross negligence as assessed by the competent court; or in case of force majeure; or by judicial resolution. Breach of contract by one party entitles the other party to damages.

An indefinite term contract may be terminated by either of the parties. An employee may cancel an indefinite term contract for any reason. On the other hand, an employer may cancel an indefinite term contract for a valid reason related to the worker’s health, inability to hold employment, his competence or conduct (personal reasons); or the requirements of the enterprise such as technological or organizational changes, economic hardship or closure of the company (economic reasons). If dismissal is on personal grounds, employer must notify his/her decision in writing.

The dismissal letter must indicate the reasons for termination and other related details. The employer must also notify the labour inspector in writing about the dismissal and provide the same information to the labour department as provided in letter of dismissal. In line with the 2017 law, dismissal may occur only for a legitimate reason. Non-observance of these rules is considered unfair dismissal and employer has to pay an indemnity, ranging from 3-months to 9-months’ pay.

Either party can terminate a contract of indefinite duration by serving a written notice or paying in lieu thereof. For terminating an indefinite term contract, the required notice period provided is as follows: fifteen days for workers paid by the hour; one month for employees, workers and labourers; and three months for supervisors, executives and equivalents. Under the Collective agreement, minimum length of notice is equal to the probation or trial period. During notice period, employee works on same terms and employment conditions except that the worker is provided 2 days per week to search for a new job.

In accordance with the Collective Agreement, severance pay is payable in the case of individual dismissals, at the following rate:

- 30% of overall average monthly salary for each year of the first five years;

- 35% of the overall average monthly salary per year from 6th to 10th year inclusive;

- 40% overall average monthly wage per year beyond the 10th year.

In the case of collective dismissals, the rate of severance pay is 35%, 40% and 45% respectively.

Severance pay is not due in case of termination of employment contract resulting from gross negligence of the employee.

Benin Tax

Employees contribute 3.6% of salary to social security.

Employers contribute 15.4% of gross salary to social security, 6.4% for pension and 9% for family allowance, plus an additional 1%-4% for industrial injury assistance.

Health Insurance Benefits in Benin

Benin is working toward universal health care but currently has a public/private system.

Benin Holidays

- New Year’s Day

- Fête du Vodoun

- Easter Monday

- Labour Day

- Eid al-Fitr

- Ascension Day

- Whit Monday

- Eid al-Adha

- Benin Independence Day

- Assumption of Mary

- Prophet’s Birthday

- All Saints’ Day

- Christmas Day

Why Choose WeHireGlobally

WeHG takes care of all the onboarding hurdles, payroll, compensation and bonuses, tax filing, and termination of employment. Our Employer of Record solution allows you to manage your foreign teams efficiently while minimizing cost and risk.

FAQ Benin

40 hours per week for all other workers.

- New Year’s Day

- Fête du Vodoun

- Easter Monday

- Labour Day

- Eid al-Fitr

- Ascension Day

- Whit Monday

- Eid al-Adha

- Benin Independence Day

- Assumption of Mary

- Prophet’s Birthday

- All Saints’ Day

- Christmas Day

Employees contribute 3.6% of salary to social security.

Employers contribute 15.4% of gross salary to social security, 6.4% for pension and 9% for family allowance, plus an additional 1%-4% for industrial injury assistance.