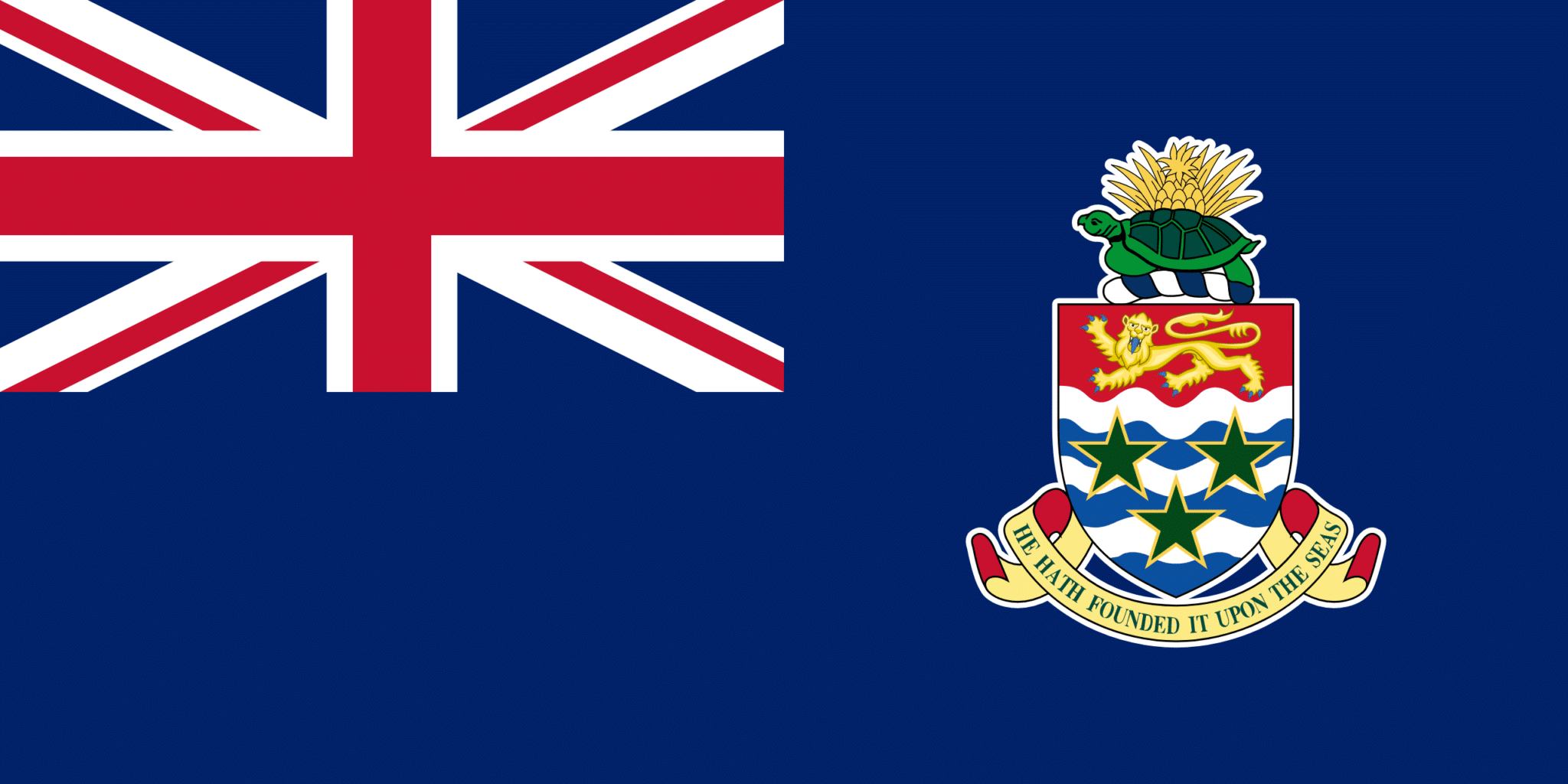

Cayman Islands

Table of Contents

Cayman Islands PEO & Employer of Record

WeHG provides an International PEO and global Employer of Record service in Cayman Islands to companies willing to enter the Cayman Islands market or hire local/expat employees in this country.

The traditional approach requires establishing a subsidiary in the Cayman Islands. However, our solution affords you to start the operations in the Cayman Islands in less than a few days hence save resources. WeHG would hire candidates on your behalf while you maintain entire operational control of their work. So legally they would be our employees, on our local payroll, 100% compliant but will work on your behalf.

Cayman Islands fast facts

Population, million: 65

Land area: 264 km²

Capital: George Town

Local currency: Cayman Islands dollar (KYD)

GDP per capita:$ 73,800

GDP in currency:$ 2.507 billion

Cayman Islands, island group and overseas territory of the United Kingdom in the Caribbean Sea, comprising the islands of Grand Cayman, Little Cayman, and Cayman Brac, situated about 180 miles (290 km) northwest of Jamaica. The islands are the outcroppings of a submarine mountain range that extends northeastward from Belize to Cuba. The capital is George Town, on Grand Cayman.

Hiring, Negotiating and Doing Business in Cayman Islands

Necessity of written employment contract

Every employee is deemed to be working under a contract of employment, regardless of whether or not they have signed a written

agreement. In Cayman it is a legal requirement to provide every employee with a written statement of their terms and conditions. Therefore, it is highly advantageous to have a written agreement in place. These can range from a simple contract to highly complex arrangements including bonus or dividend schemes, restraint of trade and confidentiality provisions.

Different forms of engagement: employment, contracting, work with private entrepreneur

If you are a global professional, entrepreneur or student and have the opportunity to work flexibly and remotely, you may want to consider The Global Citizen Certificate (GCC).

The GCC enables individuals who wish to take part to work remotely in the Cayman Islands for up to 2 years. The programme does not require that you have Cayman residency; you just have to be willing to work remotely for a company and/or business that is abroad. It is the perfect opportunity for those looking to relocate to a Caribbean paradise and take advantage of the COVID-19 pandemic’s working-from-home-exceptions. Applicants must have a minimum annual income of US$100,000 for individuals, US$150,000 for couples and US$180,000 for families.

A requirement of the GCC is that, before your arrival to the island, you must find a property to rent or buy. Many real estate companies in the Cayman Islands would be happy to help you begin your search for the perfect home, apartment, condo, or even resort suite.

Cayman Islands Employment Contract

Types of employment agreements

Employment agreements may be either oral or written. Many precedent contracts exist in industry; some are very bad and others are even contrary to the Labour Law. Section 6 of the Labour Law serves as an excellent guide to what needs to be covered at a bare minimum in any employment agreement.

Cayman Islands working hours

The standard work week in the Cayman Islands is forty-five hours, or nine hours a day. Employees who have worked for five years are entitled to receive a five-year cash grant at the end of every five years they have worked for a company. The annual leave entitled to workers depends on the Remuneration Band and the number of years they have worked in a company.

Overtime

Overtime must be paid to an employee when his or her working hours exceed either the standard working week (45 hours) or on any given day the standard work day (nine hours). Overtime must be paid by an employer at time and a half based on the employee’s basic hourly rate.

Vacation leave in Cayman Islands

The employment agreement should set out the employer’s leave policies for vacation, public holidays, sickness and maternity leave. Typically, vacation entitlement runs from a minimum of two weeks for employees with less than four completed years to a minimum of four weeks’ entitlement after 10 completed years of employment. Sick leave entitlement is 10 paid sick days, with a doctor’s certificate of the illness required after three consecutive days of illness. Maternity provisions allow for 12 weeks of maternity leave, with the first four weeks at full pay, the next four weeks at half-pay and the final four weeks with no pay.

Cayman Islands Maternity Leave

Where an employee has not completed 12 months the Law prescribes that any maternity leave may be pro-rated. You should enquire with your employer what their policy is regarding maternity leave, as some employers can be more flexible than others. There is nothing in the Law that prevents an employer from providing maternity benefits in excess of the minimums prescribed.

Currently an employer is legally required to offer 20 working days leave on full pay, 20 working days leave on half pay and 30 working days on no pay. For practical purposes this is treated by many businesses as the equivalent of six weeks at full pay, and eight weeks at no pay. Maternity leave may generally be taken in whatever portions requested by the employee, but six weeks of it must be taken after the birth of a child.

At present there is no provision in the Law for paternity leave, however, some companies will allow a new father anything from a few days to two weeks off.

Cayman Islands Law also provides for adoption leave. A female employee who adopts a child under the age of three, is entitled to adoption leave of nine calendar weeks, of which 15 working days are on full pay. Paternity leave for fathers who adopt is five days paid leave.

Cayman Islands Severance Laws

Notice pay is determined by reference to the contract of employment. Where no notice period is prescribed it is deemed to be the interval between pay days.

Accordingly (by way of example) an employee who is made redundant on 31 March and who:

has been employed by that employer for 3 years and 2 months

earns CI$6.00 per hour at basic wage for a 40 hour week (CI$12,480 per annum); and

has a 10 day annual vacation entitlement and has taken none this year;

would generally expect to be entitled to payment on redundancy of:

- 3 weeks severance of CI$720

- One month’s notice pay of CI$1,040 (assuming the employee is not asked to work during their notice period); and

- 2.5 days accrued but untaken vacation pay of CI$120.

- A person in this situation would accordingly expect payment on redundancy of CI$1,880. Such payment is payable immediately on termination.

Cayman Islands Tax

Caymanian locals and foreign nationals employed in the Cayman Islands enjoy a tax-free salary because the government does not impose any kind of income tax on its workers, noncapital gains tax or corporation tax. There is also no welfare or social security taxes imposed on residents and non-residents of the Cayman Islands.The primary source of income for the Cayman Islands is through indirect taxation.

Health Insurance Benefits in Cayman Islands

A full-time employee is entitled to ten days’ sick leave for every twelve-month period of employment and a part-time employee is entitled to sick leave calculated on a pro-rata basis in relation to the number of days accrued by a full-time employee.

The period of twelve months referred to in subsection shall be computed from the beginning of employment or the anniversary date of employment, but where the leave is not taken at the end of that period, it shall be forfeited unless otherwise agreed in the contract of employment or by prior arrangement.

Where an employee is injured in the course of his duties and the injury arises out of the nature of his employment, the number of paid sick-leave days shall be increased from ten to fifteen.

Unless otherwise expressly stated in this Law, the requirements of section 18 shall be applied as far as practicable to a work-related injury. During a period of sick leave an employee shall be paid the basic daily remuneration he would have received if he had worked on those days.

Additional Benefits in Cayman Islands

The Labour Law provides basic anti-discrimination provisions but the Gender Equality Law provides more detailed provisions to eradicate gender discrimination in the work place. It outlaws sexual harassment in the workplace and treating men and women differently in relation to terms and conditions of employment, including equality of pay. This means that employers should carefully consider their pay structures ensuring that men and women who do equal roles or work of equal value are paid the samе.

General market practice benefits/additional allowances

Most companies in Cayman receive a continuous barrage of overseas applications from people looking for jobs in the Cayman Islands, but very few are deemed to be genuine.

The minefield of applying for employment in the Cayman Islands is further complicated by the requirement to advertise any position prior to a work permit application or annual renewal. A flick through the local classifieds may give a misleading picture of the job market. Employers are discouraged from giving any indication that the position may be a work permit renewal, as this can discourage local applicants. With just over 30,000 work permits in issue as of December 31st 2019, many apparent vacancies will actually turn out to be for a work permit application or renewal.

This makes trying to find a position by reading employment classifieds something of a needle-in-a-haystack. For most job seekers, responding to such ads should only be a part of a more proactive, direct strategy.

Cayman Islands Holidays

The 2021 public holidays are:

- New Year’s Day: Wednesday, 1 January;

- National Heroes Day: Monday, 27 January;

- Ash Wednesday: Wednesday, 26 February;

- Good Friday: Friday, 10 April;

- Easter Monday: Monday, 13 April;

- Discovery Day: Monday, 18 May;

- Queen’s Birthday: Monday, 15 June (UNCONFIRMED);

- Constitution Day: Monday, 6 July;

- Remembrance Day: Monday, 9 November;

- Christmas: Friday, 25 December; and

- Boxing Day: Monday, 28 December.

Why Choose WeHireGlobally

WeHG takes care of all the onboarding hurdles, payroll, compensation and benefits, tax filing, and termination of employment. Our Employer of Record solution allows you to manage your overseas teams efficiently while minimizing cost and risk.

FAQ Cayman Islands

The standard work week in the Cayman Islands is forty-five hours, or nine hours a day. Employees who have worked for five years are entitled to receive a five-year cash grant at the end of every five years they have worked for a company. The annual leave entitled to workers depends on the Remuneration Band and the number of years they have worked in a company.

- New Year’s Day: Wednesday, 1 January;

- National Heroes Day: Monday, 27 January;

- Ash Wednesday: Wednesday, 26 February;

- Good Friday: Friday, 10 April;

- Easter Monday: Monday, 13 April;

- Discovery Day: Monday, 18 May;

- Queen’s Birthday: Monday, 15 June (UNCONFIRMED);

- Constitution Day: Monday, 6 July;

- Remembrance Day: Monday, 9 November;

- Christmas: Friday, 25 December; and

- Boxing Day: Monday, 28 December.

Caymanian locals and foreign nationals employed in the Cayman Islands enjoy a tax-free salary because the government does not impose any kind of income tax on its workers, noncapital gains tax or corporation tax. There is also no welfare or social security taxes imposed on residents and non-residents of the Cayman Islands.The primary source of income for the Cayman Islands is through indirect taxation.