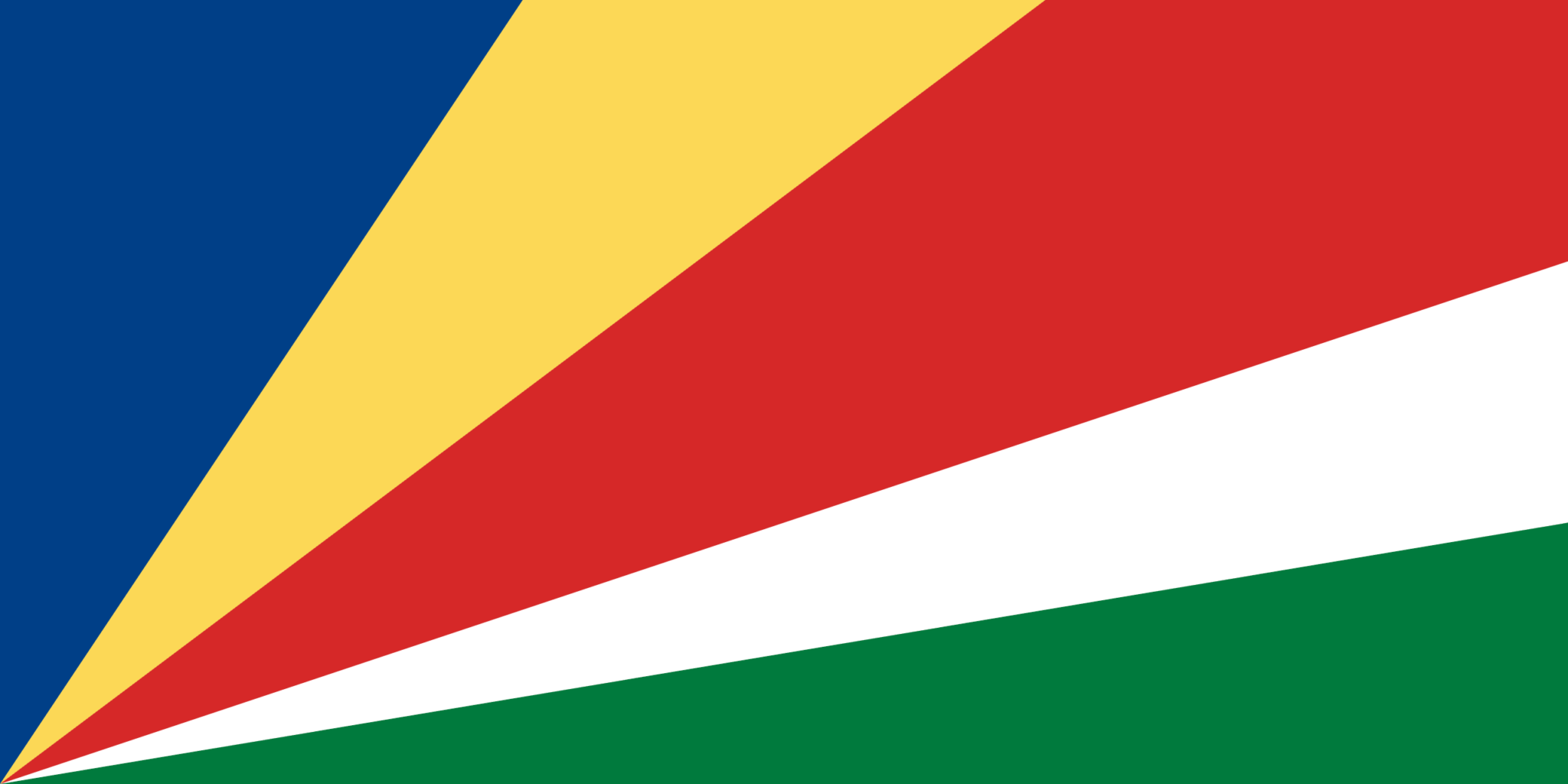

Seychelles

Seychelles PEO & Employer of Record

WeHG provides an International PEO and global Employer of Record service in Seychelles to companies willing to enter the Seychelles market or hire local/expat employees in this country.

Traditional approach requires establishing a subsidiary in Seychelles. However our solution allows you to start the operations in Seychelles within days hence save time and money. WeHG would hire candidates on your behalf while you maintain full operational control of their work. So legally they would be our employees, on our local payroll, 100% compliant but will work on your behalf.

Seychelles fast facts

Population, million: 0,09

Land area, sq. km: 459 km2

Capital: Victoria

Local currency: Seychellois rupee (SCR)

Hiring, Negotiating and Doing Business in Seychelles

Necessity of written employment contract

It is legally required to put a written employment contract in place in Seychelles, in the local language, which spells out the terms of the employee’s compensation, benefits, and termination requirements.

Seychelles Employment Contract

Types of employment agreements

Fixed term contracts are permitted.

Seychelles working hours

The standard work week may not exceed 60 hours or 12 hours per day.

Overtime is allowed of up to 60 hours per month, or 15 extra hours per week.

Vacation leave in Seychelles

Employees are generally entitled to 21 days of paid annual leave, or 1.75 days per month worked.

Sick leave:

In general, employees are entitled to 30 days of paid sick leave per year, or in cases of hospitalization, 60 days.

Seychelles Maternity Leave

Female employees are generally entitled to 14 weeks of paid maternity leave. 12 additional weeks may be taken unpaid either before or after the paid leave. Employees may not return to work until the end of their paid leave.

Seychelles Severance Laws

Employers should provide one month notice to employees working under a fixed-term contract if they intend not to renew the contract.

If terminating an employee for just cause, the employer must give the following notice:

- Casual worker: one day

- Worker on probation: seven days

- Any other Seychellois worker: one month’s notice

- Non-Seychellois worker who is also not a casual worker and not on probation: term as specified in the employment contract, or if none specified, one month’s notice

Severance pay may be due to the employee and depends upon the method of termination.

Seychelles Tax

Employers and employees each contribute 2% of wages to the pension fund.

Social Security Contributions

- Employers Contribution – 20% of emoluments

- Employees Contribution – 2.5% of emoluments

Additional Benefits in Seychelles

Annual bonuses are common in Seychelles and the government is considering extending the mandatory 13th month bonus.

Seychelles Holidays

- New Year

- Labour Day

- Liberation Day

- Constitution Day

- National Day

- Good Friday

- Easter Sunday

- Corpus Christi

- Assumption Day

- All Saints’ Day

- Immaculate Conception

- Christmas Day

Why Choose WeHireGlobally

WeHG takes care of all the onboarding hurdles, payroll, compensation and benefits, tax filing, and termination of employment. Our Employer of Record solution allows you to manage your overseas teams efficiently while minimizing cost and risk.

FAQ Seychelles

The standard work week may not exceed 60 hours or 12 hours per day. Overtime is allowed of up to 60 hours per month, or 15 extra hours per week.

- New Year

- Labour Day

- Liberation Day

- Constitution Day

- National Day

- Good Friday

- Easter Sunday

- Corpus Christi

- Assumption Day

- All Saints’ Day

- Immaculate Conception

- Christmas Day

Annual bonuses are common in Seychelles and the government is considering extending the mandatory 13th month bonus.