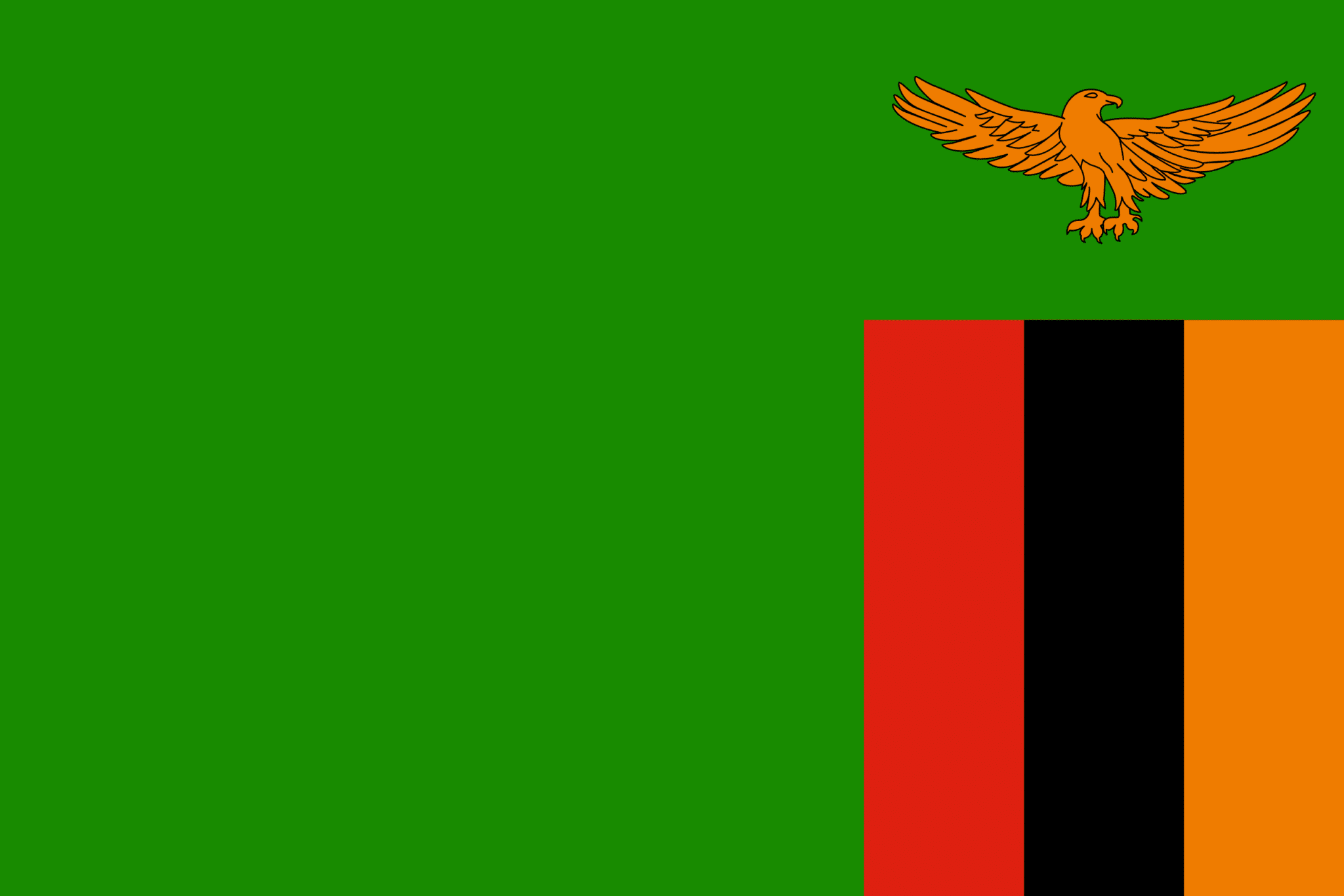

Zambia

Table of Contents

Zambia PEO & Employer of Record

WeHG provides an International PEO and global Employer of Record service in Zambia to companies willing to enter the Zambian market or hire local/expat employees in this region.

The current approach claims to establish a subsidiary in Zambia. However, our solution allows you to start the operations in Zambia in a few days hence save time and finances. WeHG would hire candidates on your behalf while you keep total operational control of their work. So legally they would be our employees, on our local payroll, 100% compliant but will work on your behalf.

Zambia fast facts

Population, million: 17

Land area: 752,618 km²

Capital: Lusaka

Local currency: Zambian kwacha (ZMW)

GDP per capita:$ 4,148

GDP in currency:$ 75.857 billion

Zambia, landlocked country in Africa. It is situated on a high plateau in south-central Africa and takes its name from the Zambezi River, which drains all but a small northern part of the country.

Large parts of the country are thinly populated. Much of population is concentrated in the country’s most developed area—known as the Line of Rail—which is served by the railway linking the Copperbelt with Lusaka, the capital, and with the border town of Livingstone.

Hiring, Negotiating and Doing Business in Zambia

Necessity of written employment contract

A written contract is legally binding once it has been signed, initialled or has been affixed with thumb/finger impressions in the presence of a person other than the employer.

Different forms of engagement: employment, contracting, work with private entrepreneur

An Employment Permit is issued to a foreigner who enters the country to take up employment for a period exceeding six (06) months. It can be extended for periods up to a maximum of 10 years. It is issued to a foreigner who is:

- Employed by the Government of Zambia or a statutory body;

- Employed by the private sector, Non-Governmental Organisations (including a person employed as a volunteer) or a religious organization; and

- The spouse and children, over twenty one years, of a foreigner may be issued with Employment Permits if they are to be employed in the family business.

A Temporary Permit is issued to: a prohibited immigrant or any person as directed by the Minister of Home Affairs; parent(s) (father, mother or foreparents only) of a holder of an Employment Permit or Investor’s Permit within the validity of the permit; and a dependant of permit holder above the age of 18.

This Permit is also issued to a foreigner who has appealed to the Minister of Home Affairs against rejection of their permit application or notice to leave Zambia.

The Temporary Permit must not be applied for unless directed by the Department of Immigration.

An Investor’s Permit is issued to a foreigner (above the age of 18 years) intending to establish a business or invest in Zambia or who has established or invested in a business in Zambia, or is joining an already existing company.

A Transit Permit is issued only to drivers of commercial trucks and their crew when they have exhausted ninety (90) business visit days. The Transit Permit is given initially for a period of one year and may be renewed for a further period of one year.

A Cross Border Permit is issued to a foreigner who is a member of a regional grouping to which Zambia is party or one who ordinarily resides in a country sharing boundaries with Zambia and is a member of an association of persons engaged in cross border business. It is issued for an initial period of ninety (90) days and may be renewed after expiry for a further period of ninety (90) days within a period of six (06) months from the date of issuance. The period granted shall not exceed six (6) months in any given period of twelve (12) months.

Zambia Employment Contract

Types of employment agreements

In accordance with the Employment Code Act 2019, there are two types of contracts only, i.e., oral and written contracts. Employment Act does not require contracts to be in writing unless required by this Act or some other law. Even in the case of oral contracts, the law requires preparation of a “record of service” in duplicate to be handed over to an employee within one month of commencement of contract. The record of contract must contain the following: the name and sex of the employee and his nationality; the name, address and occupation of the employer; the date of the employee’s engagement and the capacity in which he is to be employed; the type of contract; the place of engagement; the rate of wages and any additional payments in kind; and the intervals of payment.

A contract of employment may take one of the following forms:

- Permanent contract (expires on retirement unless terminated);

- Long term contract (contract of more than 12 months, renewable for a further term);

- Task specific contract (terminates on completion of task);

- Probationary contract (3 months)

Zambia working hours

According to the law, your normal working hours per day are 8 hours and these should not be more than 48 hours per week. By including the lunch and prayer time in hours of work, working hours should not be greater than 9 hours a day.

Overtime

Work that is performed in excess of 48 hours a week is to be paid overtime at one- and-a-half times the worker’s hourly rate of pay. Work performed on paid public holidays or on a Sunday (where Sunday is not part of the normal working week) should be paid at double the worker’s hourly rate of pay.

Vacation leave in Zambia

The full-time workers are entitled to at least 2 days of annual leave/paid holidays for one month of service. The total annual leave is 24 calendar days per year and is independent of weekly rest days and Public Holidays.

Employees are entitled to one month’s basic pay as well as other allowances for a period of one month prior to proceeding on leave. Part time employees are also allowed paid leave of absence in proportion to the number of hours worked in a month (a full time worker works 48 hours per week). An employer pays the entire amount, including holiday allowance, immediately before the worker proceeds to leave. Casual and temporary employees are not entitled to annual leave.

Zambia Maternity Leave

Employment Code Act of 2019 provides for maternity leave of 14 weeks, up from 12 weeks under the Employment Act of 1965. The compulsory post-natal leave is at least 6 weeks. In the event of multiple births, maternity leave can be extended to 18 weeks. A female worker must give a written notice to the employer, along with a medical certificate, of her intention to proceed on maternity leave on a specific date and to return to work on completion of maternity leave.

A female worker who gives birth to a premature child is entitled to extension of maternity leave (beyond 14 weeks) for a period recommended by a medical doctor. A female worker may, immediately on expiry of maternity leave before resuming duties and with the approval of the employer, proceed on sick, annual, compassionate or other leave to which the employee is entitled.

Maternity leave is fully paid leave for a worker with two years of continuous service with the employer from the date of first engagement or since the last maternity leave taken and a medical certificate confirming the pregnancy. It is funded by the employer with no support from government.

Zambia Severance Laws

Severance Pay is defined under the Employment Code Act of 2019 as “wages and benefits paid to an employee on contract termination.” The Act provides for the severance pay in the following cases:

- Termination of employment contract of a fixed duration: at least 25% of the employee’s basic pay earned during the contract period;

- Termination of employment due to redundancy: 2 months’ basic pay for each completed year of service;

- Employee’s death in service: 2 months’ basic pay for each completed year of service;

Medical discharge: at least 3 months’ basic pay for each completed year of service.

A contract of employment terminates in the manner stated in the contract of employment or in any other manner (as stated in the Employment Code Act), except that where an employer terminates the contract, the employer must give reasons to the employee for the termination of the employee’s contract of employment. Contract termination without valid reason is not allowed. Valid reasons include those connected with the capacity or conduct of an employee or based on the operational requirements of an undertaking. A worker‘ contract may not be terminated on account of conduct or performance without giving the employee an opportunity to be heard.

A contract of employment expires: at the end of the term for which it is expressed to be made; on the death of the employee before the end of the term specified in the contract; on the employee attaining the applicable retirement age, where the contract of employment is permanent in nature; or in any other manner in which a contract of employment lawfully expires or is deemed to expire.

Zambia Tax

Recent significant developments in the taxation of individuals in Zambia are as follows:

- Both employers and employees are required to make contributions to the National Pension Scheme Authority (NAPSA). The contribution rate is 5% of the employee’s total earnings (a total 10% contribution from both the employer and employee), subject to a limit as prescribed by the authority. The maximum contribution limit for 2020 is 1,149.60 Zambian kwacha (ZMW) per employee per month (i.e. a total of ZMW 2,299.20 from both the employer and employee per month).

- The government commenced the implementation of the National Health Insurance Act of 2018 in October 2019. Under the Act, employers have various obligations, including:

- registering their employees with the scheme within 30 days of commencement of employment, and

- paying an employee’s contribution to the scheme on a monthly basis (the contribution includes both the employer’s and employee’s contributions; the prescribed rate is 1% of the employee’s basic salary, making a total of 2% for both the employer and employee).

Health Insurance Benefits in Zambia

The Employment Act provides for a fully paid sick leave in the event of temporary incapacity due to sickness or some accident. In order to avail fully paid leave, the worker must provide a valid medical certificate. The employer may continue to pay for longer period however it is not required under the law.

The length of paid sick leave depends on the type of employment contract. An employee on the short-term contract is paid full pay for the first 26 working days of the sick leave and thereafter, half pay (50%) for the next 26 working days of the sick leave. An employee on the long-term contract is paid full pay during the first three months of the sick leave and thereafter, half pay for the next three months of the sick leave. Long term contracts are all such contracts with duration in excess of 12 months.

No statuary medical benefits are provided under the law. No relevant provisions could be located in law. Medical care is available to all citizens in government run hospitals at a low cost. Constitution also considers it a right to have access to health care services.

National Health Insurance Act of 2018 requires employers to register workers with the National Health Insurance Management Authority. It is a social insurance system, based on the contributions from workers and employers. Among other, the functions of the Authority will be to to implement, operate and manage the National Health Insurance Scheme; accredit health insurance healthcare providers; and develop a comprehensive benefit package to be accessed by members. The new law is yet to be implemented.

Additional Benefits in Zambia

The Zambian social security system is based on the social insurance model and protects against income loss due to retirement, disability, and death. All employed individuals in the formal sector are required to contribute to the statutory pension scheme. Individuals not covered by the scheme can contribute voluntarily. The insurance industry’s growth was recently affected by bottlenecks such as its legal framework, fiscal regime, and investment climate, which are expected to be addressed soon by the Pensions and Insurance Authority.

The main state and compulsory benefits in effect in Zambia include old age, survivor’s and disability pension; short-term sickness benefits; workmen’s compensation insurance; maternity benefits, and medical care benefits. In Zambia, Pillar II forms the voluntary occupational pension system. Employers provide voluntary occupational pension schemes to the employees through DB or DC plans. Hybrid plans are also available in the country.

General market practice benefits/additional allowances

Types of businesses you can start in Zambia:

- Import and export

This is one of the most lucrative ideas because Zambia imports most of its products. However, if you don’t have experience with importing and exporting, you could have a tough time implementing your idea. Start by learning the basics. Once you’re comfortable with your knowledge of the business, start teaching others what they need to know to get started. By doing this, you’ll probably gain you your first few clients. And, if you keep having small seminars, and you’ll expand your reach and develop a sufficient and ongoing customer base very quickly.

- Catering

If you have the knack for cooking, this could be a good business for you. You could offer business lunches or party catering. To build a customer base, create relationships in your community. You could offer a free dish at church events and ask for client testimonials as a way to show potential new customers what you have done at past events. Also, you can make yourself available to cook at funerals and make sure everything you cook is memorable. And, while you’re at it, distribute fliers to whoever takes interest. The initial cost might be high because you’ll have to have samples of your cooking available for future clients to taste.

- Translator

Do you fluently speak another language? If you do, you can turn this valuable skill in to a business by offering your services to businesses and government offices.

- Delivery service

This is a costly service to set up, so register your business and start with your car, in your city. If you enjoy exploring different places, then a courier business could be a good fit for you. Market your services to small businesses.

- Event planning

One of the first things you need to do is visit every potential event location with which you plan to work. Work with the marketing manager to tour each site and learn what is available at each location. Start a database that will allow you to sort venues by varying features–the number of people each site holds, if there is AV equipment available on site, will you need to arrange for rental chairs, etc. Then when you are beginning to plan an event with a client, you can find out what the key parameters are for the event and easily pull up the three or four sites that meet the basic criteria. and engagement parties, etc.

- Flea market

People love to spend time going through tables full of other people’s unwanted items, looking for treasures. Make sure to change your layout and put new stuff out for sale often. You want people to come back time and again to see what’s new. You don’t even have to have that much new stuff to make things look new. Just moving an item from a table to the top of a bookshelf might get it noticed, even though the item has been in your inventory since you first started having sales.

- Photography

Making money as a photographer can be done in a number of different ways. You can specialize in one area, the most common being weddings. There are niches you can explore for photography: portraits of people and their pets, families, and homes; photographs of holiday events, birthday parties or Christmas cards; the possibilities are endless.

- Online content production

If you have a knack for grammar and love to write, content production for websites could be a cheap business startup for you. Cost to kick off this business includes a computer and an Internet connection.

- Business plan service

Offer a great business plan, including market research, the business plan narrative and the financial statements. Plan your fee around the main one that the client will want and offer the others as add-on services. You can give clients an electronic file and allow them to take it from there, or you can keep the business plan on file and offer the service of tweaking it whenever necessary.

- Consultant

Maybe you’ve changed careers during your working life. Offer your skills to that former industry as a paid consultant. Since you worked in the industry, you already have contacts you could market to as being available for hire.

Zambia Holidays

Workers are entitled to paid holidays during Festival (public and religious) holidays. These include memorial holidays and religious holidays (Christian origin).

- The Public Holidays are usually 11 in number. It includes:

- New Year’s Day

- Youth Day (12th March)

- Good Friday

- Holy Saturday

- Labour Day (1st May)

Why Choose WeHireGlobally

WeHG takes care of all the onboarding hurdles, payroll, compensation and benefits, tax filing, and termination of employment. Our Employer of Record solution allows you to manage your overseas teams efficiently while minimizing cost and risk.

FAQ Zambia

According to the law, your normal working hours per day are 8 hours and these should not be more than 48 hours per week. By including the lunch and prayer time in hours of work, working hours should not be greater than 9 hours a day.

- The Public Holidays are usually 11 in number. It includes:

- New Year’s Day

- Youth Day (12th March)

- Good Friday

- Holy Saturday

- Labour Day (1st May)

Both employers and employees are required to make contributions to the National Pension Scheme Authority (NAPSA). The contribution rate is 5% of the employee’s total earnings (a total 10% contribution from both the employer and employee), subject to a limit as prescribed by the authority. The maximum contribution limit for 2020 is 1,149.60 Zambian kwacha (ZMW) per employee per month (i.e. a total of ZMW 2,299.20 from both the employer and employee per month).